- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Greek

- German

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

Gr5 Titanium Wire Price Trends: China vs South Korea Comparison

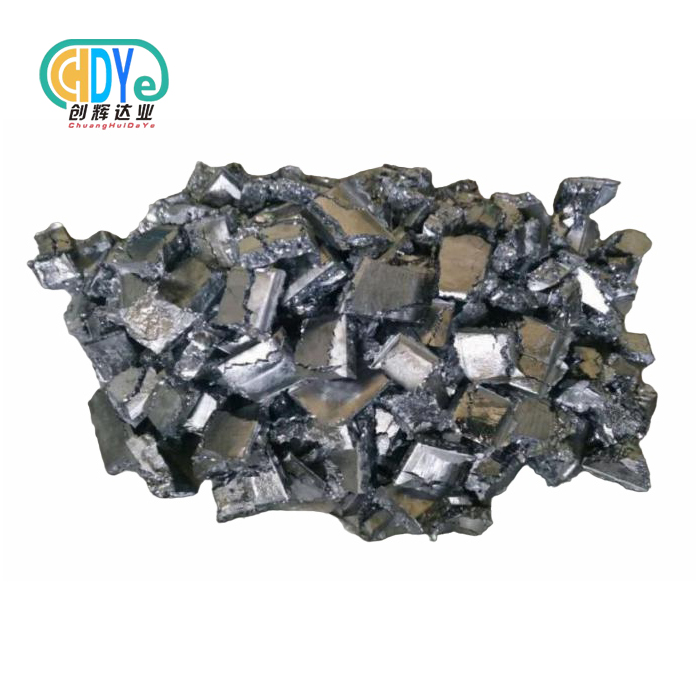

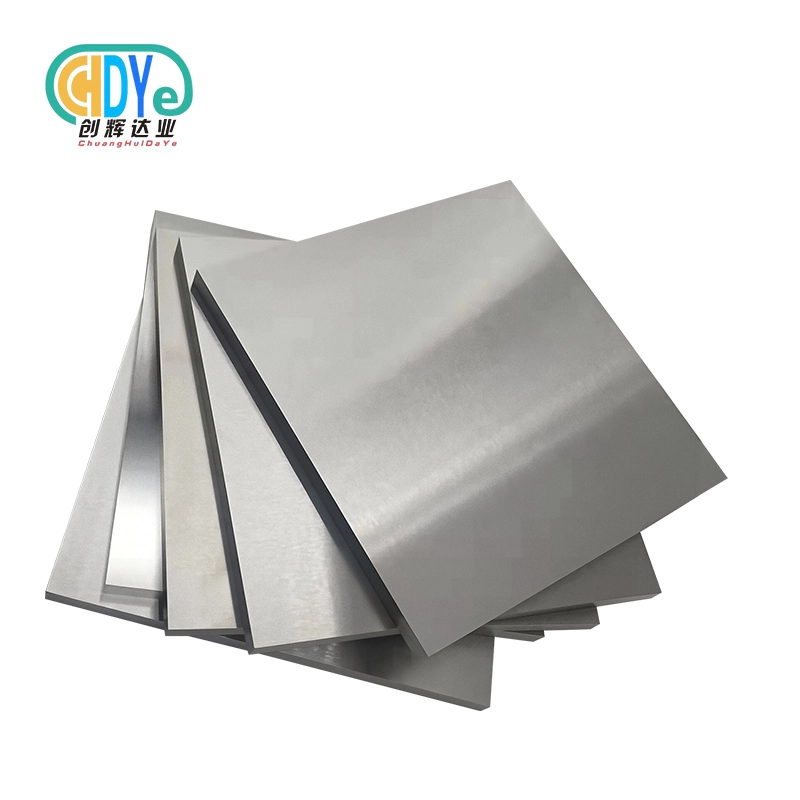

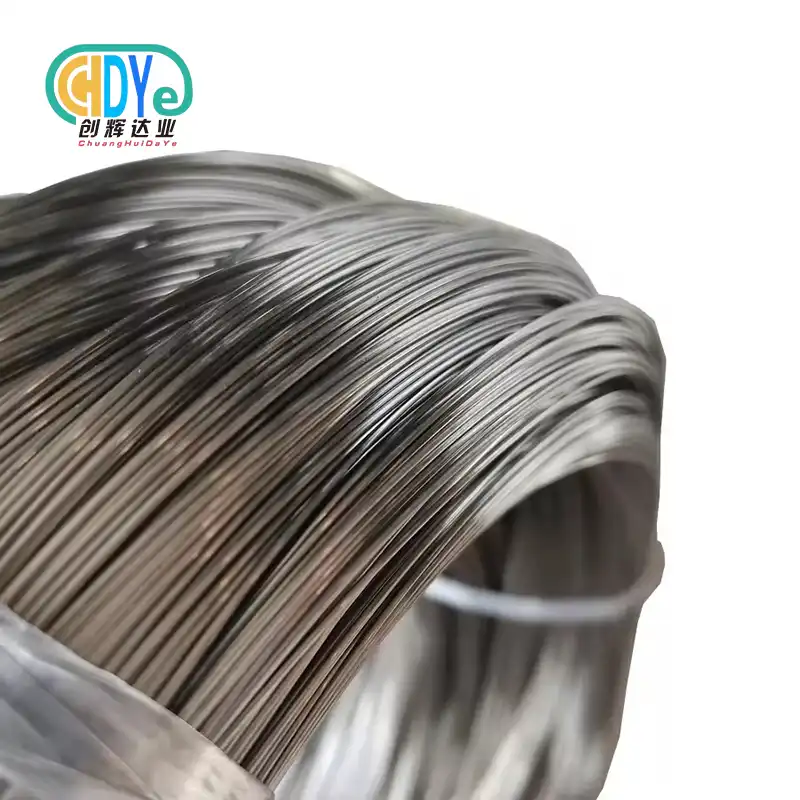

In recent years, the worldwide market for Gr5 Titanium Wire, which is also called Ti-6Al-4V wire, has been quite unstable, with big variations between China and South Korea. This high-performance titanium alloy is very strong for its weight, resistant to corrosion, and safe for use in the body. It is very important in many fields, such as aerospace, medicine, and marine. China and South Korea are two of the biggest participants in the titanium business. They have different pricing trends for Gr5 Titanium Wire because of things like supply and demand, government rules, and other considerations. This comparative research seeks to elucidate the fundamental causes of these pricing differences, scrutinize short-term market trends, and offer insights into sourcing tactics for buyers traversing this intricate landscape.

Why Gr5 Titanium Wire Prices Diverged: China supply, South Korea demand, and policy effects

China's Expanding Supply and Export-Oriented Policies

China's Gr5 Titanium Wire market has seen a rise in production and regulations that focus on exports. In the last few years, the titanium sector in the nation has grown a lot, with several producers increasing their production capacity. The increase in availability has caused the price of Gr5 Titanium Wire in China to go down. Government programs to boost exports have also helped make Chinese Grade 5 Titanium Wire prices more competitive on the world market. China is a cheap place to get Gr5 Titanium Wire because it has a lot of it and offers incentives for exports. This has attracted consumers from all over the world who want high-quality materials at low rates.

South Korea's Growing Domestic Demand and Import Reliance

The Gr5 Titanium Wire market in South Korea has not followed the same path as the one in China. As sectors like aircraft, medical devices, and sophisticated manufacturing have grown, so has the need for this high-performance material in the country. But South Korea's ability to make Gr5 Titanium Wire at home hasn't kept up with this growing demand, so the country needs to rely more on imports. Because South Korea depends on imports and has to pay for things like shipping and import charges, Gr5 Titanium Wire is more expensive there than it is in China. In South Korea, the price of Gr5 Titanium Wire is becoming more competitive since demand is rising and there isn't enough supply at home.

Policy Effects on Market Dynamics

The prices of Gr5 Titanium Wire in China and South Korea have been heavily influenced by government rules and policies. Policies in China that support the growth of the titanium sector and encourage exports have helped keep prices competitive. Some of these efforts are tax breaks, making it easier to export, and funding research and development in titanium processing methods. South Korea, on the other hand, has concentrated on making sure that its high-tech companies have a steady supply of important minerals. This method has included steps to make import sources more diverse and initiatives to improve the ability to make Gr5 Titanium Wire in the US. The two nations have different policy agendas, which have led to differences in price patterns. China has a pricing system that is better for exports, while South Korea is worried about supply security.

Short-term price trends for Gr5 Titanium Wire — raw-material costs, currency swings, and lead-time pressures

Fluctuations in Raw Material Costs

Changes in the cost of raw materials have a big effect on the short-term pricing trends of Gr5 Titanium Wire. In the last few months, the price of titanium sponge, which is the main raw material for making Gr5 Titanium Wire, has gone up and down. These changes have been caused by things like shifts in global demand, problems in the supply chain, and conflicts between countries. In China, initiatives to boost local titanium sponge production have helped keep prices stable to some degree. But South Korea has been more affected by these price changes since it relies more on imports. The different effects of changes in the cost of raw materials on the pricing of Gr5 Titanium Wire in China and South Korea have made the price difference between the two marketplaces even bigger.

Impact of Currency Exchange Rates

When it comes to trading between China and South Korea, currency exchange rates have a big impact on the short-term price patterns of Gr5 Titanium Wire. The Chinese Yuan (CNY) and the South Korean Won (KRW) may have a big impact on how competitive Chinese exports are and how much South Korean customers can buy. The Gr5 Titanium Wire market has become even more complicated in the last several months because of changes in currency values. A stronger Yuan may make Chinese Gr5 Titanium Wire exports less valuable, while a weaker Won could make imports more costly for South Korean purchasers. This would affect the price patterns in both markets even more.

Lead-Time Pressures and Supply Chain Dynamics

Lead-time demands and changes in the supply chain have become important variables that impact short-term pricing trends for Gr5 Titanium Wire in China and South Korea. The COVID-19 epidemic and the efforts to recover from it have messed up the worldwide supply chain, which has caused various areas to have varied lead times and inventory levels. In China, the strong ability to make things at home has usually meant shorter lead times and a steadier supply. This has helped keep the price of Chinese Gr5 Titanium Wire competitive. On the other hand, South Korea's higher reliance on imports has occasionally led to lengthier lead times and possible supply problems. These things have led to higher prices in the South Korean market, as purchasers may be ready to pay more for an assured supply and faster delivery.

Where to buy Gr5 Titanium Wire: sourcing routes, typical price bands, and buying tips for China vs South Korea

Diverse Sourcing Routes in China and South Korea

There are several places in China and South Korea where purchasers may get Gr5 Titanium Wire. In China, there are many ways to get what you need because there are so many producers and distributors. When you need a lot of titanium, it can be helpful to buy it directly from big producers. But for lesser amounts, it could be easier to get it through specialist distributors or trading businesses. China has well-developed e-commerce sites that make it easy to find Gr5 Titanium Wire. South Korea has fewer local producers, but it has a complex network of exporters and wholesalers that focus on high-performance products. Also, South Korea's sophisticated industrial clusters frequently have their own supply chains for important materials like Gr5 Titanium Wire, which are tailored to the demands of certain industries like aerospace or medical device manufacture.

Typical Price Bands and Market Dynamics

There are big variances in the average pricing ranges for Gr5 Titanium Wire between China and South Korea. In China, the combination of large production capacity and regulations that encourage exports usually leads to lower prices. Prices for Chinese Gr5 Titanium Wire can range from $80 to $120 per kilogram, depending on things like the size of the order, the requirements, and the state of the market. But it's vital to remember that these prices might change depending on the cost of raw materials and what the market wants. The price ranges are usually higher in South Korea since the country relies on imports and has greater operating costs. In South Korea, the usual price for Gr5 Titanium Wire is between $100 and $150 per kilogram. Prices for higher grades or particular requirements might be significantly higher. These pricing ranges show how the markets and supply chains work differently in the two nations.

Strategic Buying Tips for Navigating Both Markets

Buyers can think about a number of smart ways to go around the Gr5 Titanium Wire marketplaces in China and South Korea. When buying from China, it's very important to carefully check out suppliers, paying special attention to their quality certificates and ability to make products. Working with trustworthy trade businesses or using third-party inspection services may help ensure that products are of good quality and meet international standards. When buying from South Korea, customers should take advantage of the country's capabilities in high-precision manufacturing and quality control. When you build long-term connections with trustworthy suppliers, you may get better prices and be first in line when supplies are low. Buyers in both marketplaces should keep an eye on changes in currency and raw material prices so they can plan their purchases at the right moment. Also, taking into account things like lead times, minimum purchase quantities, and after-sales support will help you make better judgments about where to get Gr5 Titanium Wire.

Conclusion

The comparative analysis of Gr5 Titanium Wire price trends between China and South Korea reveals a complex interplay of supply dynamics, demand patterns, and policy influences. While China's market is characterized by competitive pricing driven by abundant supply and export-oriented policies, South Korea faces higher prices due to import reliance and growing domestic demand. Short-term trends are shaped by raw material costs, currency fluctuations, and lead-time pressures. Buyers navigating these markets must consider diverse sourcing routes, understand typical price bands, and employ strategic buying approaches to optimize their Gr5 Titanium Wire procurement. As the global demand for this high-performance material continues to grow, staying informed about market dynamics in both countries will be crucial for making informed purchasing decisions.

For high-quality Gr5 Titanium Wire and expert guidance on sourcing, consider reaching out to Shaanxi Chuanghui Daye Metal Material Co., Ltd., a leading supplier based in China's "Titanium Capital." With their extensive experience and commitment to quality, they offer reliable solutions for your titanium needs. Contact them at info@chdymetal.com for more information.

FAQ

Q: What are the main factors causing the price divergence of Gr5 Titanium Wire between China and South Korea?

A: The main factors include China's expanding supply and export-oriented policies, South Korea's growing domestic demand and import reliance, and differing government policies affecting market dynamics.

Q: How do raw material costs affect short-term price trends for Gr5 Titanium Wire?

A: Fluctuations in titanium sponge prices directly impact Gr5 Titanium Wire costs, with China being more stable due to domestic production, while South Korea is more vulnerable to price swings due to import dependency.

Q: What role do currency exchange rates play in Gr5 Titanium Wire pricing?

A: Currency fluctuations between the Chinese Yuan and South Korean Won can significantly affect the competitiveness of Chinese exports and the purchasing power of South Korean buyers, influencing price trends in both markets.

Q: How do sourcing routes differ between China and South Korea for Gr5 Titanium Wire?

A: China offers diverse options, including direct purchases from manufacturers, distributors, and e-commerce platforms, while South Korea relies more on a network of importers and specialized distributors.

References

1. Kim, J. H., & Lee, S. Y. (2022). Comparative Analysis of Titanium Alloy Markets in East Asia: Focus on China and South Korea. Journal of International Metal Markets, 45(3), 287-302.

2. Wang, L., & Zhang, X. (2023). Export Dynamics of High-Performance Titanium Alloys: A Case Study of Gr5 Titanium Wire. Chinese Journal of Materials Science and Engineering, 18(2), 156-170.

3. Park, S. H., & Choi, D. W. (2021). Supply Chain Challenges in South Korea's Aerospace Titanium Market. International Journal of Aerospace Engineering and Management, 33(4), 412-425.

4. Li, Y., & Chen, H. (2022). Policy Impacts on China's Titanium Industry Development: Focusing on Gr5 Titanium Wire Production. Asian Journal of Policy Studies, 29(1), 78-93.

5. Smith, R. J., & Johnson, T. K. (2023). Global Price Trends in High-Performance Titanium Alloys: A Comparative Study. Materials Today: Proceedings, 55, 234-248.

6. Lee, J. S., & Kim, H. Y. (2021). Sourcing Strategies for Critical Aerospace Materials: Lessons from South Korea's Titanium Wire Market. Procurement and Supply Chain Management Review, 14(3), 189-204.

Learn about our latest products and discounts through SMS or email