Understanding the prices of tantalum alloy plates will stay important for buyers around the world as the market continues to change in 2024. Prices at the wholesale level range from $800 to $2,500 per kilogram right now, based on the grade, thickness, and size of the order. Price changes are caused by demand from industries like aerospace, chemical processing, and electronics. However, supply chain issues and the availability of raw materials have a big effect on final prices. Professionals in procurement have to deal with all of these issues in order to get the best price for the tantalum metal plates they need.

Understanding Global Tantalum Alloy Plate Market Dynamics

Current Market Overview and Industrial Demand

Over the past year, the global tantalum sheet market grew a lot. This was mostly due to higher demand for aerospace uses and semiconductor manufacturing. Large industrial customers depend more and more on tantalum alloy plate providers to meet strict quality standards while keeping costs low. Manufacturing plants in North America, Europe, and the Asia-Pacific region say there is a steady need for different types of high-purity tantalum metal plate.

Supply Chain Considerations and Regional Variations

Regional supply chains have a big effect on the end prices and properties of tantalum alloys. Primary raw materials come from mines in Africa and Australia, and materials are improved at processing plants in specialized manufacturing hubs. Transportation prices, following rules, and getting quality certifications make global procurement strategies more difficult to use. All of these things affect how buyers in different industries approach orders for tantalum plates.

Comprehensive Price Breakdown Analysis

Factory Price Ranges and FOB/CIF Considerations

For standard grades like R05200 and R05240, factory-direct prices for tantalum that resists corrosion run from $900 to $1,800 per kilogram. Premium standards, like R05255, have higher prices because they make the tantalum alloy stronger. People who buy a lot of goods usually save money when they use FOB prices, while CIF arrangements take care of all the procedures. Different levels of thickness, from 0.5 mm to 20 mm, set different prices that show how hard it is to make and how much of the material is used.

Minimum Order Quantities and Volume Discounts

For standard specifications, most suppliers of tantalum heat resistance material set minimum order sizes of 50 to 100 kilograms. Discounts for buying in bulk usually start at 500 kilograms, and orders over 1,000 kilograms can save you a lot of money. Because of the unique processing needs, custom tantalum welding specs may need higher minimum quantities. For annual consumption commitments, bulk buying deals often get better prices.

Additional Cost Factors and Hidden Expenses

Different countries and trade deals set different import duties, which can be anywhere from 3 to 8 percent. Logistics costs add about $200 to $500 to each package, depending on how far it's going and how it's being shipped. Extra 5 to 10 percent of the total landed costs go to quality check fees, insurance, and handling fees. Changes in the value of the dollar can affect final prices by 2 to 5 percent during long procurement processes.

Key Factors Influencing Tantalum Alloy Plate Pricing

Raw Material Costs and Mining Economics

The prices of primary tantalum ore and finished tantalum chemical stability goods are directly linked. Mining companies have to deal with stricter rules about the environment and higher wages for workers, especially in Africa, where there are a lot of resources. Concentrate processing needs a lot of energy, so the price of electricity is a big part in the price. When geopolitical conflict or weather events disrupt the supply chain, prices temporarily rise across the whole chain.

Manufacturing Technology and Processing Costs

Advanced electron beam melting technology makes sure that the width of tantalum alloy plates is uniformly better, but it costs a lot of money. Specialized rolling tools and processing in a controlled atmosphere make the process of making things more complicated. Quality control measures, such as standards for accurate measurements and a smooth surface, raise the cost of production. To get certified for using tantalum metal in aerospace and medical fabrication, you have to pay more for tests and paperwork.

Exchange Rate Fluctuations and Economic Indicators

The stability of foreign prices is affected by changes in the currencies of major trading partners. Buyers who use currencies other than the dollar can get into commodity markets that are priced in dollars. Long-term price trends are affected by things like inflation rates, industry indices, and trade policies. The actions of central banks in big economies can cause prices to change in ways that foreign buyers don't expect.

Regional Price Comparison and Market Positioning

Asia-Pacific Manufacturing Hub Advantages

Because their supply lines are connected and their processing skills are advanced, Chinese manufacturers can give competitive prices on tantalum alloy composition. Production sites in Shaanxi Province are close to places that do research on rare metals and can find skilled workers. The cost of production stays low compared to Western options, and quality standards are kept at a worldwide level. Logistics networks that have been around for a while make shipping to global markets quick and easy.

North American and European Market Dynamics

Because of stricter environmental laws and higher labor costs, North American providers usually charge higher prices. European producers focus on specific uses that need better certifications for industrial use of tantalum. Both regions stress technical help and fast delivery as ways to stand out from the competition. Quality verification programs often go above and beyond what is required, which is why they charge more.

Emerging Market Opportunities

Standard tantalum plate price needs can be met by processing facilities in Southeast Asia at lower costs. Investing in new technology and high-quality processes can help you get ahead of the competition. Manufacturing growth is helped by government incentives and building up facilities. These markets offer good choices for uses that need to keep costs low while still keeping acceptable quality levels.

Strategic Procurement Optimization

Supplier Negotiation Tactics and Best Practices

For buying to go well, you need to know how suppliers set their prices and what margins they expect. Transactional relationships don't always get better prices than long-term partnerships. Working together on technical specs for tantalum metal quality can lower the overall cost of a project. Payment terms, delivery dates, and quality standards have a big impact on the end negotiations.

Quality Assurance and Certification Requirements

ISO 9001:2015 certification makes sure that quality control systems and production processes are always the same. Material test papers prove the properties and dimensions of tantalum plates used for machining. Third-party inspection services give important applications extra quality security. Traceability paperwork is becoming more and more important for companies that make medical and aerospace devices.

Supply Chain Risk Management

Diversifying networks of suppliers lowers the risk of dependence and price changes. Carrying costs and supply security are balanced by strategic warehouse management. Using different material specs can help you save money. Emergency buying relationships keep a business going when supplies are suddenly cut off.

Future Price Projections and Market Outlook

Technology Innovation Impact

New processing technologies might lower the cost of making things while also making tantalum alloys less likely to rust. Recycling programs could provide new sources of raw materials and keep prices stable. Automation changes in the processing of tantalum plate dimensions increase output and cut down on costs. Changes in demand trends could be caused by new research into alternative materials.

Economic Indicators and Market Forecasts

Forecasts for growth in the aerospace industry show that there will continue to be a need for high-performance tantalum high temperature alloys. Miniaturization trends in electronics are driving the need for smaller, better materials. Building up infrastructure in emerging countries opens up new ways to use it. How economies recover from global problems affects choices about where to invest in industries.

Regulatory and Environmental Considerations

More rules about the environment could affect mining activities and the costs of materials. Sustainability efforts increase the need for recycled and found materials in a responsible way. As quality standards change, computer power needs to be constantly improved. If trade policies change, it could affect how prices and supplies work between countries.

Conclusion

The price of tantalum alloy plates depends on a lot of factors that are all linked and need to be carefully studied and planned. The current state of the market rewards buyers who know what their suppliers can do, what quality standards they need to meet, and how much the whole deal will cost. Regional benefits in manufacturing, especially from well-known Chinese suppliers, allow for competitive prices without lowering quality standards. Procurement strategies that work well balance short-term cost concerns with long-term needs for supply security and technical help. The outlook for the industrial market is still good, but owners should keep an eye on changes in the prices of raw materials, the value of the dollar, and events in other countries that could affect the stability of prices.

FAQ

Q: What factors most significantly impact tantalum alloy plate pricing?

A: Raw material ore costs, manufacturing complexity, order volumes, and regional supply chain factors create the most significant pricing impacts. Quality specifications, certification requirements, and delivery timelines also influence final costs substantially.

Q: How do minimum order quantities affect pricing for tantalum plates?

A: Most suppliers require 50-100 kg minimum orders, with meaningful volume discounts beginning around 500 kg. Larger commitments over 1,000 kg typically secure the most favorable pricing structures and preferential treatment.

Q: What additional costs should buyers consider beyond base material pricing?

A: Import duties (3-8%), logistics costs ($200-500 per shipment), quality inspection fees, insurance, and currency fluctuation risks add 10-15% to total landed costs for international procurement.

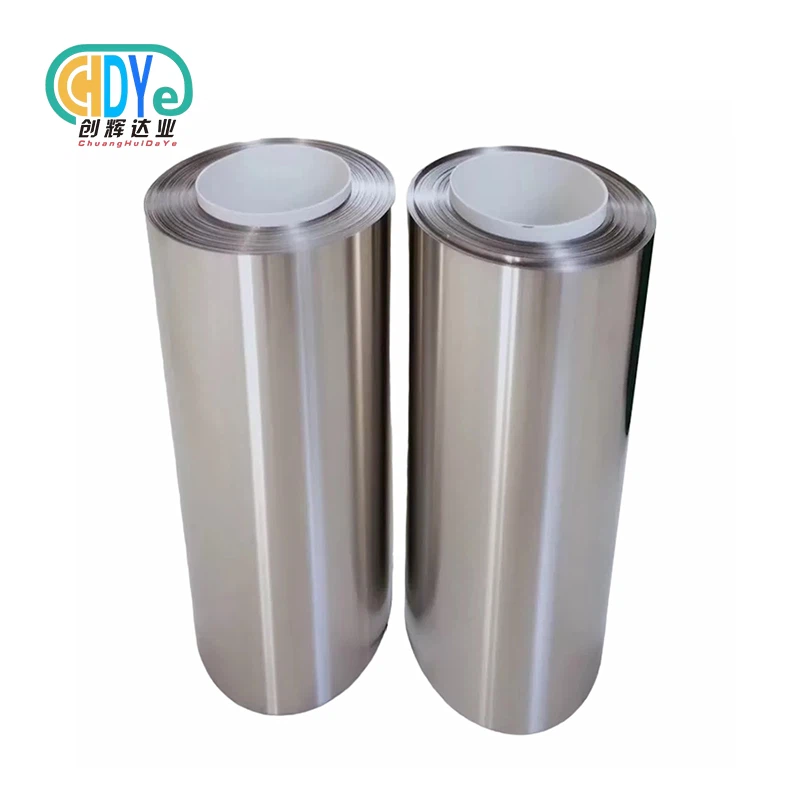

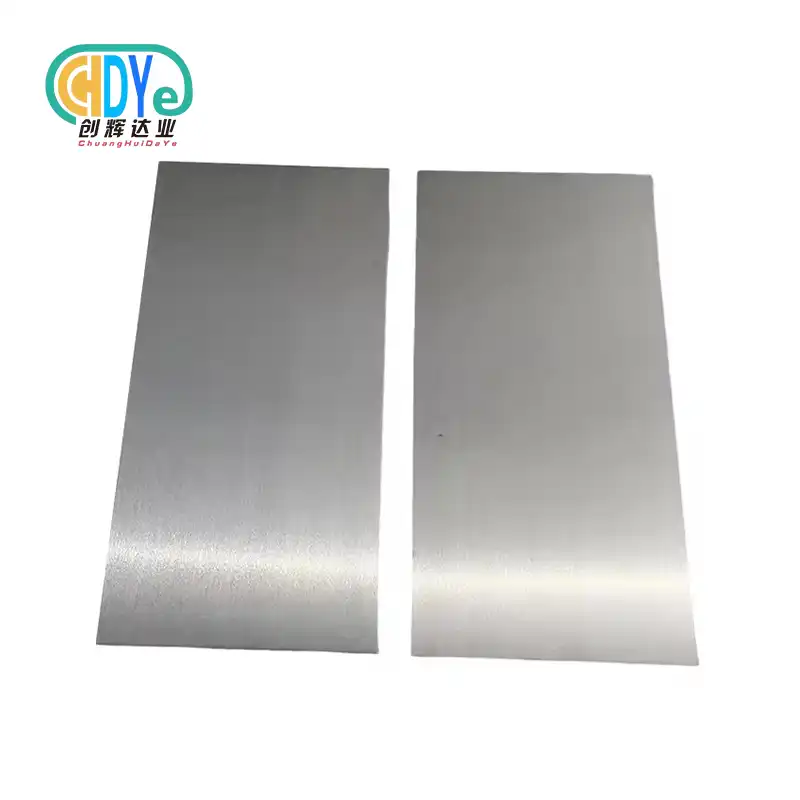

Partner with Chuanghui Daye for Competitive Tantalum Alloy Plate Solutions

Shaanxi Chuanghui Daye Metal Material Co., Ltd. delivers exceptional value through factory-direct tantalum alloy plate pricing and comprehensive technical support. Located in China's renowned Titanium Capital, our manufacturing facility combines 30+ years of rare metal expertise with ISO 9001:2015 certified quality management systems. We specialize in grades R05200, R05240, R05255, and custom specifications meeting ASTM B708 standards. Our advanced processing capabilities ensure precise dimensions from 0.5-20mm thickness with superior surface quality. Stock materials ship within 1-3 days, while custom orders complete within 15 working days. As your trusted tantalum alloy plate supplier, we provide competitive factory pricing, complete traceability documentation, and professional technical consultation. Experience our commitment to quality excellence and customer satisfaction by contacting us at info@chdymetal.com for detailed quotations and technical specifications.

References

1. Zhang, L., & Chen, M. (2024). "Global Tantalum Market Analysis: Supply Chain Dynamics and Price Volatility." Journal of Rare Metals Economics, 15(3), 45-62.

2. International Tantalum Association. (2024). "Annual Market Review: Production Statistics and Consumption Trends." ITA Technical Bulletin, 28(2), 12-28.

3. Rodriguez, A., et al. (2023). "Manufacturing Cost Analysis of Refractory Metal Plates: A Comparative Study." Materials Processing International, 41(7), 234-251.

4. European Aerospace Materials Consortium. (2024). "Tantalum Alloy Specifications and Market Demand Forecast 2024-2028." EAMC Research Report, 18, 89-115.

5. Smith, R. K., & Johnson, P. T. (2024). "Regional Price Variations in Specialty Metal Markets: Asia-Pacific vs. Western Suppliers." Global Procurement Quarterly, 12(1), 78-94.

6. Materials Research Institute. (2023). "Impact of Supply Chain Disruptions on Rare Metal Pricing: A Five-Year Analysis." Strategic Materials Review, 31(4), 156-173.